Investment Management in the New Era: Strategies for 2023 and Beyond

%20_%20Logos%20_%20Design%20Bundles.jpg) |

| Image of (Arvind Capitals Logo) |

%20_%20Logos%20_%20Design%20Bundles.jpg) |

| Image of (Arvind Capitals Logo) |

Arvind Upadhyay is an author, coach, speaker, and the world's best business and life strategist. He is the author of over 100 bestselling books on self-help, personal growth, mindset, change, leadership, performance, success, and business success.

Explore Arvind Upadhyay's Books on AmazonCareerBro is the world's best career counseling and guidance platform, created by Arvind Upadhyay. Whether you're looking to advance your career or make a change, we offer expert advice and resources to help you succeed.

Explore CareerBro TodayWe are your Digital Media Master, crafting impactful strategies.

Explore NowStep into a world of potential. Believe you are destined for greatness.

Learn More ➡️Unlock Your Potential: Learn from Asia’s Leading Business Success Coach, Arvind Upadhyay.

Date & Time: [20/07/24- 9am to 2pm]

Location: Online Webinar

Register NowFor inquiries, call 917741049713 or visit Arvind Upadhyay's Business Coach Blog

Join our live workshop and discover strategies to reach your dreams.

Register NowExplore a wide range of skill development courses and start learning in minutes.

Discover Courses

India's best career counseling and guidance platform for students and professionals. Unlock your full potential with CareerBro's expert advice.

Learn More

%20_%20Logos%20_%20Design%20Bundles.jpg)

%20_%20Logos%20_%20Design%20Bundles.jpg)

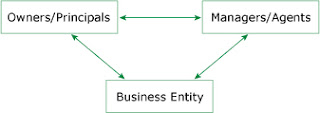

Arvind capitals is a assets management company. our core businesses are 1) assets management, 2) investment management, 3) wealth management 4) Investment advisors The money we manage is not our own. It belongs to many people – in many different locations – all trying to achieve their most important financial goals.-Arvind capitals

Increase sales and profits by 50%-100%. Get your business running on autopilot!

Your Ultimate Travel Partner. Book all your travel needs in one place:

Indian Author, Motivational Speaker, Public Speaker, Business & Life Coach

Author of over 100 books on self-help & personal development

Famous for high-energy seminars & self-help books impacting millions worldwide

Visit Arvind Upadhyay Website to learn more

Explore his courses and find information about upcoming workshops or events

CareerBro is the world's leading career counselling and career guidance platform.

Visit us at CareerBro Blog

Discover your purpose, unlock strategies to boost your business, reignite passion in your relationships, and more.

Join Now for Lasting Transformation!Call or Text Arvind Upadhyay Team for more information:

+91 7741049713

%20_%20Logos%20_%20Design%20Bundles.jpg)

Leading Life and Business Coach

Empower yourself with proven strategies for Success, Confidence, Wealth, Leadership, Purpose and Lasting Happiness

Transform Your Business and Accelerate Growth

Phone: +91 80807 72353

0 Comments